Got an Emergency? Your IUL is Like a Secret Stash, But Better Than Your 401(k)!

- Brendon Thomas

- 08 Sep, 2025

Life is full of surprises, right? One minute everything's fine, and the next, your car breaks down, your roof starts leaking, or your kid gets into that dream college you didn't quite budget for. When these unexpected things pop up, most people think, "Uh oh, where am I going to get the money?"

If you're like most folks, your 401(k) might be the first place you think of. It's that big retirement account you've been working hard to fill. But here's the catch: grabbing money from your 401(k) before you're old enough to retire (usually 59 ½) can hit you with some really nasty penalties and taxes. It's like borrowing money from a friend who then charges you extra fees and a high-interest rate – no fun!

What if there was a better way? A way to get cash when you need it, without those annoying penalties? That's where your Indexed Universal Life (IUL) policy comes in, acting like your super-accessible secret stash.

Your IUL: Money When You Need It, No Questions Asked (Well, Almost!)

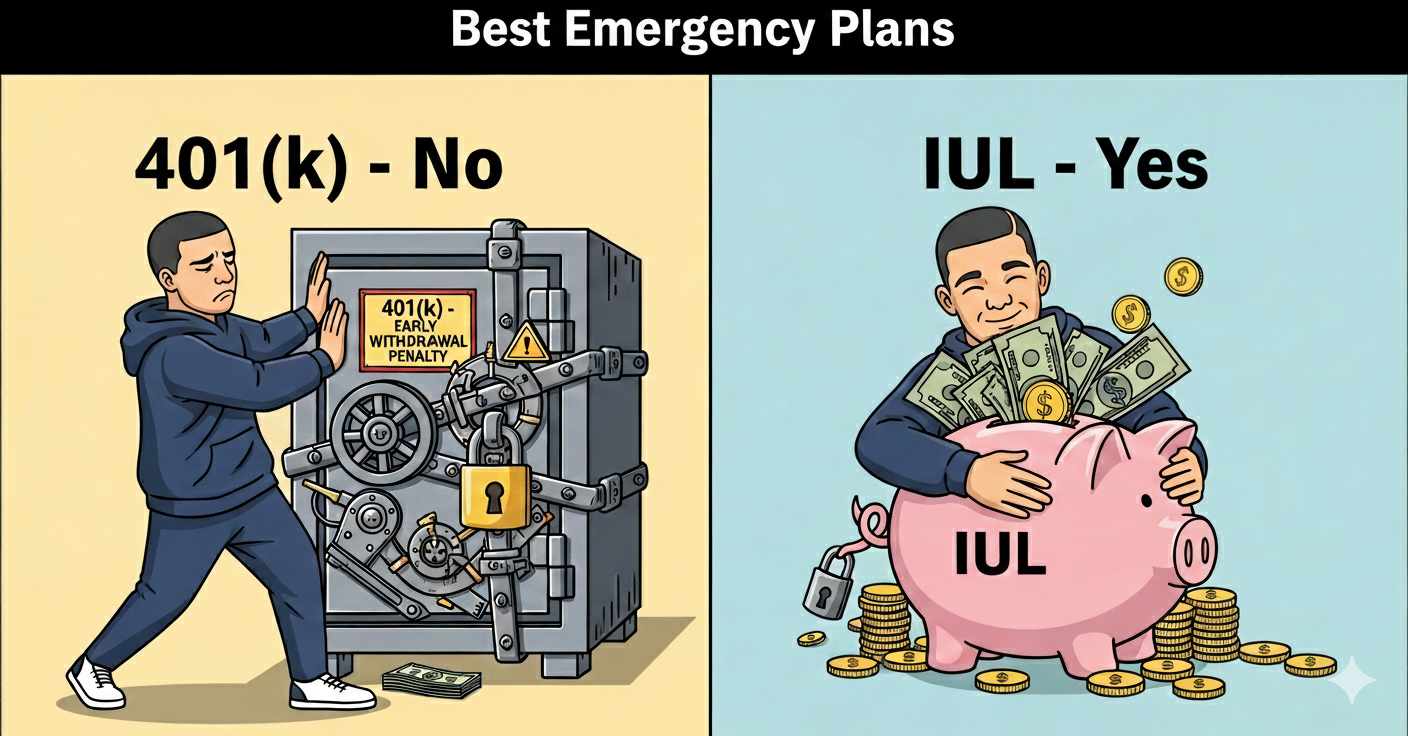

Remember how we talked about your IUL being like a smart piggy bank that grows safely? Well, it's also a piggy bank you can actually get money from easily when life throws a curveball.

Here’s the simple truth:

- No Penalties, No Stress: If you need money for an emergency, you can take a loan from the cash value inside your IUL. The best part? There are generally **no penalties** for doing this, unlike your 401(k). You won't get slammed with extra fees just because you needed your own money.

- It's Your Money, Not the Bank's: When you take a loan from your IUL, you're essentially borrowing from yourself. The money is there, ready for you to use for things like:

- Unexpected Medical Bills: Accidents happen, and medical costs can be huge.

- Home Repairs: A leaky roof or a broken furnace won't wait.

- College Funding: That dream university tuition sometimes needs a little extra boost.

- Starting a Business: Maybe that side hustle needs a kickstart!

IUL vs. 401(k) for Emergencies: Why IUL Wins

Think of it like this:

- Your 401(k) for Emergencies: Imagine a really fancy, locked treasure chest. You can get the gold out, but you need a special key, and if you open it too early, a guardian goblin (the IRS) will take a chunk of your gold as a penalty, plus taxes.

- Your IUL for Emergencies: This is like a second treasure chest, but it has a much easier lock. You can open it and take out some gold whenever you need it, with no goblin penalties and without huge taxes. You just put it back when you can, or let your policy eventually pay it back.

So, while your 401(k) is still super important for your main retirement savings, your IUL gives you a flexible, penalty-free way to access cash for those "life happens" moments. It's about having options and control over your hard-earned money.

Ready to Build Your Own Accessible Financial Safety Net?

Don't wait for an emergency to realize you need better access to your money. An IUL can be a smart, flexible way to save, grow, and access your funds when you truly need them, without the harsh penalties of other retirement accounts.

If you are ready to build an emergency fund that grows, book a free call with us to know more.