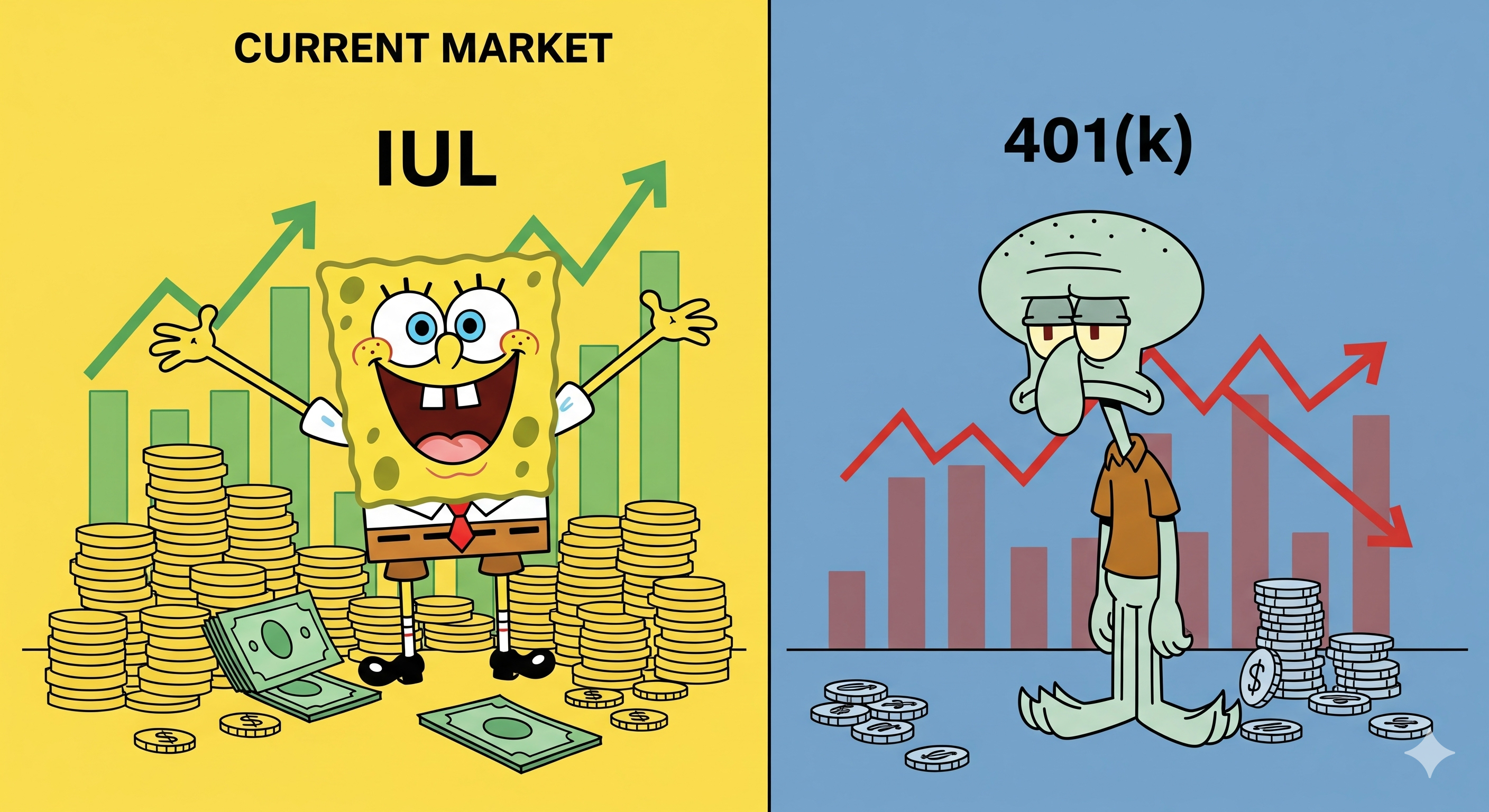

Your 401(k) is Tanking. Here’s a Safer Way to Build Wealth

- Brendon Thomas

- 10 Sep, 2025

You’re in the prime of your life. You’ve worked hard, you've started a family, and you’re focused on building a secure future. Your 401(k) has been the main tool in your plan, but when you saw its value drop recently, it was a gut punch. It made you realize that relying on a single, volatile account for your family's future might not be the best strategy.

It's time to explore a smarter, more secure way to build wealth—one that protects your money from the market's worst days.

The Problem with a "Market Only" Plan.

Your 401(k) is a great tool, and you should absolutely take advantage of any employer match. But its main drawback is that it’s completely exposed to the stock market. When the market goes up, your money grows. When it goes down, your account balance shrinks, and there's nothing you can do about it. For someone in their mid-career, this can be terrifying, because you're getting closer to retirement and don't have decades to recover from a major market crash.

Meet the IUL: Your "No-Loss" Powerhouse

Imagine a savings account that gives you a chance to earn money when the stock market is doing well, but has a secret shield that protects you from all the bad stuff. That's an Indexed Universal Life (IUL) policy.

Here’s the simple breakdown:

- Your money isn’t directly in the stock market. Instead, its growth is tied to a market index, like the S&P 500. Think of it like a game where you get points based on how well your favorite team plays, but you never lose points if they have a bad game.

- The IUL’s secret shield is called a "floor." This floor is typically set at 0%. If the market tanks and your chosen index has a terrible year, your cash value simply doesn't earn any interest for that year. It stays exactly where it was. You don't lose a single dollar of your accumulated gains.

- Your gains are "locked in." Once your money has earned interest, it's safe. It can't be taken away by a future market crash.

This "no-loss" feature is the biggest difference between an IUL and your 401(k). While your 401(k) balance might bounce up and down, your IUL's cash value is designed to only move in one direction: up.

More Than Just a Savings Account

An IUL offers benefits that a 401(k) simply can’t.

- Tax-Free Money: The cash value in your IUL grows without being taxed, and you can even take out money through policy loans later on— completely tax-free. Imagine having a source of income in retirement that doesn't add to your tax bill.

- Early Access (Without Penalties): Need to cover a child's college tuition or a major medical expense? You can access the cash value in your IUL at any age without the 10% penalty you'd face for an early withdrawal from your 401(k)

- A Safety Net for Your Family: Since it's a life insurance policy, an IUL also provides a death benefit. This means if something happens to you, your family gets a tax-free payout, providing an extra layer of financial security.

Is an IUL Right for You?

An IUL isn't a replacement for your 401(k), especially if your employer offers a great match. Instead, it’s a powerful companion—a smart, safe, and flexible alternative to diversify your wealth-building strategy. It’s perfect for the person who wants to grow their money safely, protect their family, and sleep better at night knowing their financial future isn't tied to the whims of the stock market.

If you’re ready to learn more about how an IUL can help you build wealth on your own terms, schedule a free appointment below with our certified agent.